Calculate your Customer Acquisition Cost (CAC) quickly with our free CAC Calculator to optimize marketing spend and boost business growth.

Customer Acquisition Cost (CAC) Calculator

Understanding how much it costs to acquire a new customer is critical for any business. Our Customer Acquisition Cost (CAC) Calculator helps you determine this key metric in seconds, giving you actionable insights to optimize your marketing and sales strategy.

What is Customer Acquisition Cost (CAC)?

Customer Acquisition Cost (CAC) is the average amount a business spends to acquire a new customer. It includes all marketing and sales expenses, such as:

Advertising campaigns (Google Ads, Facebook Ads, etc.)

Sales team salaries and commissions

Marketing software and tools

Content creation and promotion

How to Use the CAC Calculator

Using our Customer Acquisition Cost Calculator is simple:

Enter your total sales and marketing expenses over a specific period (monthly, quarterly, or yearly).

Enter the number of new customers acquired in that same period.

Click Calculate, and instantly get your CAC.

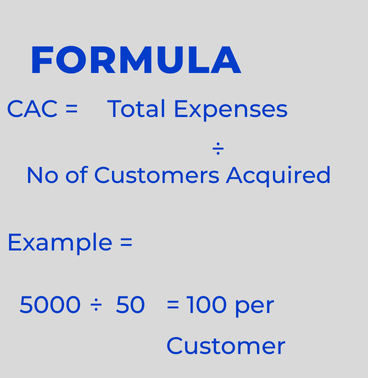

Example:

Total Marketing & Sales Costs: $5,000

New Customers Acquired: 50

CAC=5000 / 50 =100

This means you spend $100 on average to acquire one customer.

Why Knowing CAC is Important

Optimize Marketing Spend

Understanding CAC allows you to identify which campaigns deliver the best ROI and reduce wasted marketing budget.Measure Profitability

Compare CAC with Customer Lifetime Value (CLV) to see if acquiring a customer is profitable.Improve Sales Strategy

Helps sales and marketing teams make data-driven decisions for targeting and conversion strategies.Scale Business Efficiently

Low CAC combined with high CLV ensures sustainable growth and better financial planning.

CAC Benchmark by Industry

CAC varies across industries. Knowing your sector benchmark can help you evaluate performance:

| Industry | Average CAC |

|---|---|

| SaaS | $200–$1,200 |

| E-commerce | $45–$150 |

| Finance & Banking | $300–$1,500 |

| B2B Services | $150–$500 |

Tips to Reduce Customer Acquisition Cost

Focus on high-ROI marketing channels

Optimize landing pages and conversion funnels

Implement referral and loyalty programs

Automate repetitive sales & marketing tasks

Retarget warm leads effectively

Frequently Asked Questions

Customer Acquisition Cost (CAC) is calculated by dividing the total marketing and sales expenses by the number of new customers acquired during a specific period.

Example: If you spend $10,000 on marketing and sales in a month and acquire 100 new customers, your CAC is $100 per customer.

The CAC cost per customer is simply the average amount of money your company spends to gain one customer. It shows how much investment is required to convert a lead into a paying customer.

For example, if your CAC is $120, it means your business spends $120 to acquire each customer.

To calculate acquisition cost, sum up all sales and marketing expenses (ads, salaries, software, overheads) and divide them by the number of new customers gained in that time frame.

Simple Formula:

Acquisition Cost=Total Acquisition Expenses / Total New Customers

The CAC cost per acquired customer is the same as CAC per customer. It reflects the exact cost required to acquire one customer through marketing and sales activities.

Example: $15,000 spent on sales/marketing ÷ 150 customers acquired = $100 CAC per acquired customer.

The correct CAC formula is:

CAC= Total Sales + Marketing Costs / Number of Customers Acquired

Where sales and marketing costs include advertising spend, employee salaries, tools, commissions, and overheads linked to customer acquisition.

The math formula is straightforward:

CAC=Total Customer Acquisition Costs / Number of New Customers

This formula is universally accepted in finance, marketing, and SaaS industries to measure acquisition efficiency.

You calculate customer acquisition cost (CAC) by identifying:

All marketing and sales expenses (ads, content creation, salaries, software, etc.).

The number of customers acquired in that same time period.

Then divide the total expenses by the customer count.

The cost of acquisition (CAC) is calculated by:

Adding all costs related to acquiring customers (digital ads, sales team salaries, email marketing, CRMs, etc.).

Dividing that sum by the number of new customers acquired in that period.

To calculate CAC for a company:

Choose a time frame (monthly, quarterly, yearly).

Add all acquisition costs (marketing + sales + tools + staff).

Count how many new customers were acquired in that period.

Divide expenses by customers.

Example: $50,000 spent ÷ 500 new customers = $100 CAC for the company.

The KPI (Key Performance Indicator) for CAC uses the same base formula:

CAC=Total Acquisition Spend / Number of New Customers

However, when used as a KPI, CAC is often compared to Customer Lifetime Value (CLV) to measure profitability. A good CLV:CAC ratio is usually 3:1 (each customer should generate 3x the cost of acquisition).